The Open Banking Revolution: How APIs Unlock Secure Data Sharing with PSD2 Compliance

Posted by: Deepak | July 25, 2024

Categories: PSD2, Open Banking APIs, Secure Data Sharing

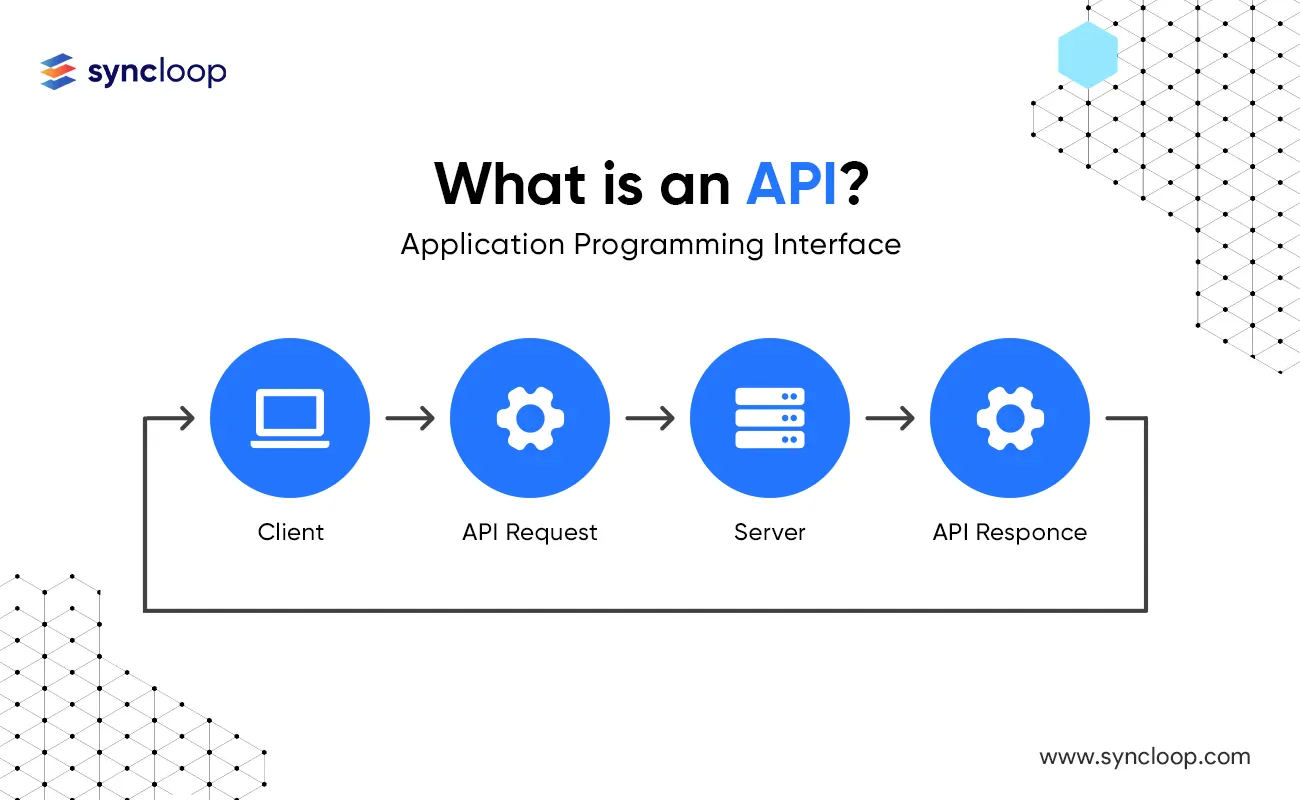

The financial services landscape is undergoing a significant transformation driven by Open Banking and the Revised Payment Services Directive (PSD2). Open Banking mandates the secure sharing of customer financial data with authorized third-party providers (TPPs) through APIs (Application Programming Interfaces). This blog delves into the critical role APIs play in Open Banking, explores the technical considerations for PSD2 compliance, and discusses the benefits, use cases, and potential challenges associated with this evolving regulatory landscape.

Open Banking: Empowering Customers with Data Control

Open Banking fosters a more competitive and innovative financial ecosystem by giving customers greater control over their financial data. They can now authorize TPPs, such as FinTech startups or financial comparison services, to access their account information and initiate payments securely through APIs.

Statistics highlight the growing adoption of Open Banking:

A study by Accenture reveals that 64% of European consumers are interested in using Open Banking services.

Here are some key principles of Open Banking:

- Customer Consent: Customers explicitly grant TPPs access to their financial data through a secure authorization process.

- Standardized APIs: Open Banking utilizes standardized APIs to ensure secure and interoperable communication between banks and TPPs.

- Strong Customer Authentication (SCA): Robust authentication measures, like two-factor authentication, are mandatory to safeguard access to customer data.

The Role of APIs in Open Banking and PSD2 Compliance

APIs serve as the foundation for secure and standardized data exchange in Open Banking. Here's how APIs facilitate Open Banking and PSD2 compliance:

- Secure Data Sharing: APIs provide a secure channel for TPPs to access customer data with explicit consent, adhering to PSD2's data security requirements.

- Standardized Communication: Standardized API specifications ensure consistent data formats and functionalities for communication between banks and TPPs, regardless of the specific technology platforms involved.

- Enhanced Innovation: APIs empower TPPs to develop innovative financial products and services by leveraging customer data securely through authorized access.

- Improved Developer Experience: Well-defined API specifications with clear documentation streamline development efforts for TPPs integrating with Open Banking platforms.

Technical Considerations for PSD2 Compliance

Here are some key technical considerations for banks and TPPs to ensure PSD2 compliance with API integrations:

- API Security: Robust security measures like encryption, access controls, and regular vulnerability assessments are crucial to protect sensitive financial data.

- Strong Customer Authentication (SCA): APIs must support SCA protocols like PSD2's mandated two-factor authentication to verify user identity before granting access to financial data.

- API Monitoring: Continuous monitoring of API activity is essential for detecting suspicious behavior and preventing unauthorized access attempts.

- Data Minimization: TPPs should only request and access the minimum amount of data necessary to fulfill their authorized functionalities.

Integrating Open Banking APIs: Benefits and Use Cases

Open Banking APIs offer numerous benefits for both banks and TPPs:

For Banks:

- Increased Customer Engagement: By providing secure access to customer data, banks can foster deeper customer relationships by enabling innovative financial services through TPP integrations.

- New Revenue Streams: Banks can explore new revenue models through collaboration with TPPs and monetization of Open Banking data access.

For TPPs:

- Faster Innovation: Open Banking APIs accelerate the development of innovative financial products and services by leveraging customer data securely.

- Enhanced User Experience: TPPs can create personalized financial solutions and improve user experience by utilizing customer data with consent.

Here are some specific use cases for Open Banking APIs:

- Personal Finance Management (PFM): FinTech startups can leverage Open Banking APIs to develop PFM applications that aggregate financial data from various accounts, providing users with a holistic view of their finances.

- Payment Initiation Services (PIS): TPPs can utilize Open Banking APIs to initiate payments directly from a user's bank account on their behalf, eliminating the need for manual bank transfers.

- Account Information Services (AIS): TPPs can access account information through Open Banking APIs to provide financial comparison services or creditworthiness assessments for loan applications.

Challenges and Considerations

While Open Banking offers significant benefits, there are also some challenges to consider:

- Security Concerns: Ensuring robust API security and data privacy remains a paramount concern for both banks and TPPs.

- Standardization Challenges: While there's progress towards API standardization, inconsistencies across different Open Banking implementations can create integration complexities.

- Shifting Regulatory Landscape: Keeping pace with evolving regulations and ensuring ongoing compliance can be a challenge for both banks and TPPs.

Latest Tools and Technologies for Open Banking Integration

- Open Banking Sandbox Environments: Many regulatory bodies and financial institutions provide sandbox environments for developers to test and experiment with Open Banking APIs in a secure and controlled setting.

- API Management Platforms: Platforms like Apigee, Kong, and AWS API Gateway can be leveraged to manage Open Banking APIs, enforce access control policies, and monitor API activity for security purposes.

- Open Banking Compliance Tools: Tools are emerging to assist with PSD2 compliance, including automated testing frameworks for verifying API security and data privacy practices.

How Syncloop Can Enhance Your Open Banking Integration Strategy

Syncloop plays a valuable role in your Open Banking integration strategy:

- API Design for Open Banking: Syncloop's visual design environment facilitates collaborative design of Open Banking APIs, ensuring alignment with PSD2 compliance requirements like strong customer authentication and data minimization principles.

- Clear Documentation and Version Control: Syncloop promotes clear and comprehensive documentation of Open Banking APIs, including details on data access permissions and security considerations. Version control features ensure changes to API design are tracked and documented for auditability.

- Collaboration and Communication: Syncloop fosters communication between API development teams, compliance officers, and security experts throughout the Open Banking integration process.

Conclusion

Open Banking, driven by APIs and PSD2 regulations, represents a significant shift in the financial services landscape. By embracing Open Banking and leveraging APIs strategically, banks and TPPs can unlock a wealth of opportunities for innovation, enhanced customer experience, and the development of a more competitive and dynamic financial ecosystem. Syncloop, along with your chosen API development tools and security practices, can be a valuable asset in your journey towards secure and compliant Open Banking integrations. Remember, a well-defined API strategy is crucial for navigating the Open Banking landscape and capitalizing on its potential to empower both financial institutions and FinTech innovators.

Back to Blogs